The Rise of Green Mortgages in the UK

57% of Major UK Lenders Are Now Onboard, Signalling a Shift in Sustainable Home Financing [1].

Picture this – a housing market that not only serves our needs, but also sustains our planet. This is no longer a distant dream, but an emerging reality in the UK, thanks to the rise of Green Mortgages. These aren’t just financial products; they’re a beacon of hope in a world wrestling with environmental challenges. Green Mortgages are redefining the concept of home ownership, blending financial prudence with environmental mindfulness.

The UK Climate Change Committee estimates £250 billion will be invested in UK home upgrades by 2050, which indicates that there is potential for significant capital flow in green mortgages in the coming years [2].

The Green Mortgage Revolution

Gone are the days when eco-friendly choices were an afterthought in home financing. Today, Green Mortgages are leading a revolution, offering perks like lower interest rates and cash incentives for those who embrace energy efficiency. It’s not just about saving pounds; it’s about saving the planet. These mortgages are a testament to a shift in people’s thinking.

Dive into the numbers, and you’ll see a clear trend. Recent findings from the Mortgage Advice Bureau indicate a notable surge in the market. About 57% of major UK lenders now offer Green Mortgage options, up by 4% from last year [1]. This rise isn’t just about figures, it’s a shift in priorities, both at the consumer and policy level.

More Than Just Savings

The allure of Green Mortgages extends beyond mere monetary gains. They’re about living in homes that breathe sustainability, contributing to a significant cut in carbon emissions. Imagine a world where your home doesn’t just shelter you, but also preserves the environment.

Eligibility

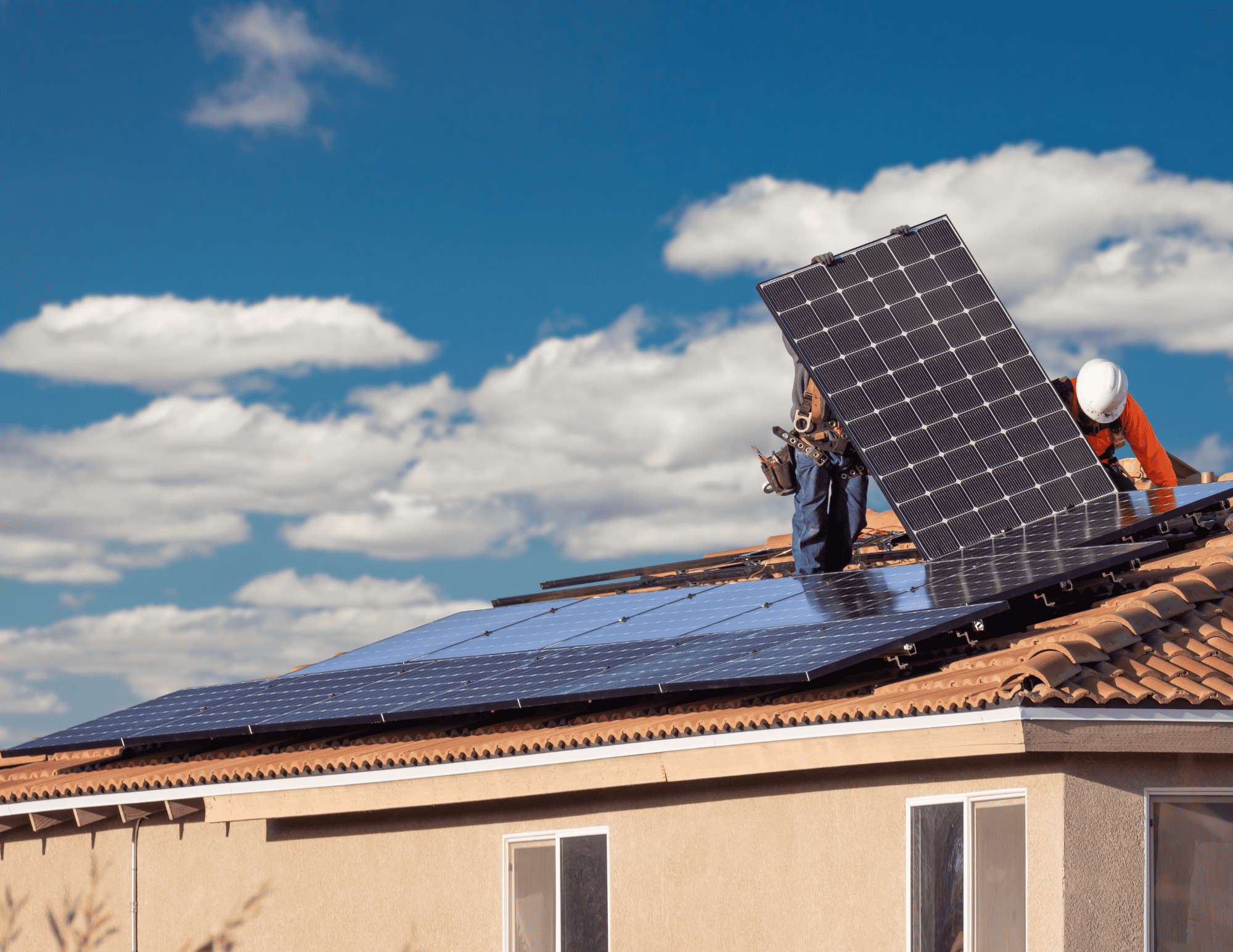

Securing a Green Mortgage goes beyond ticking boxes on a form. It’s an opportunity to prioritise energy efficiency in your property. Lenders aren’t just looking at numbers; they’re looking at potential – the potential for solar panels, advanced insulation, for greener living. It’s a rigorous process, but one that’s reshaping the landscape of property assessments.

The road to green isn’t without its bumps. The limited pool of eligible properties poses a challenge, reflecting the need for a broader transformation in the industry. The journey to a Green Mortgage is also a learning curve for many, highlighting the need for better consumer education and understanding.

Adapting to Economic Realities

Let’s face it: going green has its costs. But here’s where the narrative changes – almost 59% of lenders see Green Mortgages as a permanent fixture in their portfolios [3]. This isn’t just about adapting to market demands, it’s about leading a movement.

The horizon looks promising for Green Mortgages. With technological advancements and evolving policies, we’re likely to see a broadening of the criteria, making green living more accessible – a future where Green Mortgages aren’t the exception, but the norm.

_________

Green mortgages are more than financial products; they’re a commitment to a greener, more sustainable future. They offer a unique opportunity for homeowners and buyers to make choices that benefit both their wallets and the world. As we move forward, Green Mortgages will play an important role in shaping not just the housing market, but also the environmental legacy we leave behind.

Watch this space!

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Status Mortgage Services is a trading style of Status Financial Services Limited (Company number 08983516) which is an appointed representative of the Openwork Partnership, a trading style of Openwork Limited which his authorised and regulated by the Financial Conduct Authority.

Approved by The Openwork Partnership on 30/01/24

SOURCE DATA:

[1] Mortgage Introducer – More UK lenders offer green mortgages, research suggests

[2] Green Finance Institute – Green Mortgages

https://www.greenfinanceinstitute.com/programmes/ceeb/green-mortgages/

[3] Mortgage Introducer – Green mortgage market – what are the key trends?